TCS Q3 FY26 Results: Profit Declines 14% Even as Revenue Grows — What Investors Should Know

Tata Consultancy Services (TCS), India’s largest IT services company and a bellwether for the broader technology sector, released its third-quarter (Q3) financial results for the fiscal year 2025–26 on January 12, 2026. The quarterly figures show a nuanced performance — with profit slipping but revenue continuing to grow, reflecting ongoing shifts in demand and operational costs in the global tech services market. (The Economic Times)

📉 Profit Falls Despite Growth Momentum

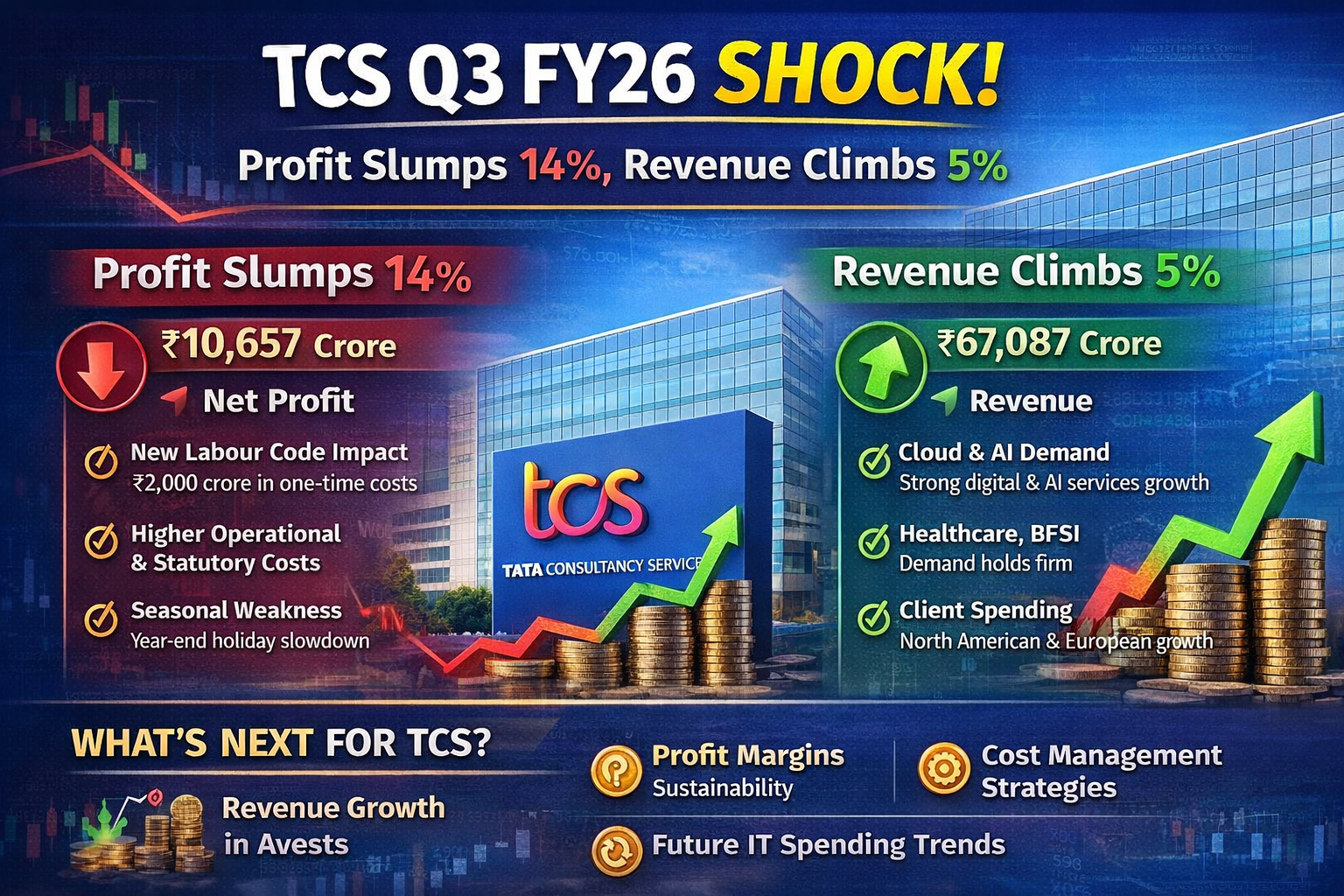

In Q3 FY26 (October–December 2025), TCS reported a consolidated net profit (PAT) of ₹10,657 crore, marking a roughly 14% decline year-on-year from ₹12,380 crore in the same quarter last year. This decline comes amid a series of cost pressures, including the impact of new regulatory frameworks and one-time statutory expenditures. (The Economic Times)

📈 Revenue Still on the Rise

Despite the drop in profitability, TCS’s revenue from operations grew about 5% year-on-year to approximately ₹67,087 crore. This top-line growth shows that demand for TCS’s services remains positive, especially in areas like digital transformation and cloud adoption — although it is still within a moderate range compared to past peaks. (The Economic Times)

💡 Why the Profit Decline? Key Factors Explained

Several factors contributed to the profit drop:

New Labour Code Impact: TCS recorded a one-time statutory cost of over ₹2,000 crore due to the implementation of India’s updated labour regulations, which affected gratuity provisions and long-term benefits. Without this charge, the company said profit would have shown a healthier gain. (ETHRWorld.com)

Exceptional Items & Operational Costs: Beyond regulatory impacts, TCS incurred legal provisions and restructuring costs that also weighed on the bottom line. (Moneycontrol)

Seasonal Market Effects: Q3 is traditionally softer due to holiday shutdowns in key markets like North America and Europe — the largest revenue contributors. Reduced billable days and cautious client spending patterns also played a role. (Reuters)

📌 Dividend & Shareholder Returns

Despite the profit dip, TCS announced a total dividend payout of ₹57 per equity share, which includes both an interim and a special dividend. This underscores the company’s sustained focus on returning value to shareholders, even in a muted earnings environment. (mint)

🚀 AI Services and Future Growth Areas

One of the notable positives from the quarter was the ongoing strength in artificial intelligence (AI)-related services. TCS reported that annualised AI services revenue reached around $1.8 billion, registering solid sequential growth — a sign that demand for AI solutions continues to be a strategic driver for the firm. (Moneycontrol)

The company also highlighted ongoing investments in cloud, cybersecurity, data platforms, and next-gen technologies, which could help sustain growth as traditional services markets remain competitive.

📊 What This Means for Investors

TCS’s Q3 performance reflects a transitional phase in its business:

Revenue growth remains resilient, though modest.

Profit margins are impacted by regulatory changes and one-off charges.

Interest in AI and digital services continues to rise, positioning TCS for future demand.

For investors, the takeaway is that while short-term earnings may show softness, the company’s continued focus on strategic growth areas and shareholder returns paints a broader picture of resilience. (Reuters)