Why Are Sensex and Nifty Falling?

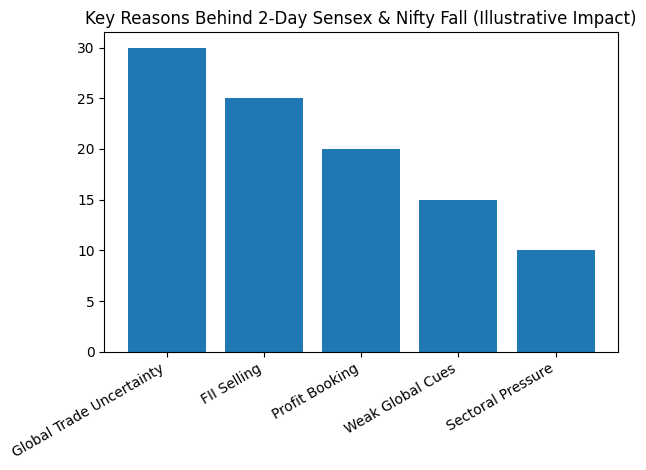

1. Global Trade and Tariff Uncertainty

One of the primary reasons for the recent market weakness is renewed global trade uncertainty, especially related to potential tariff actions and protectionist policies in major economies. Such developments create fear of slower global trade, which directly impacts emerging markets like India.

When global investors become cautious, capital tends to move out of equities and into safer assets, increasing selling pressure in stock markets.

2. Weak Global Market Cues

Indian markets often take direction from global indices. Over the past few sessions, U.S. and Asian markets have shown volatility, driven by concerns around interest rates, inflation data, and geopolitical risks.

This global risk-off sentiment reduced investor confidence and limited fresh buying in Indian equities.

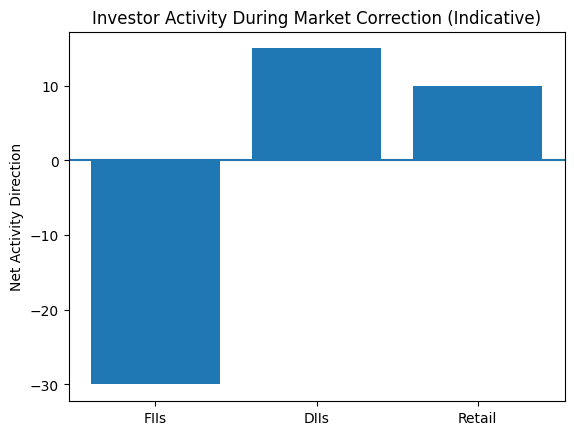

3. Foreign Institutional Investor (FII) Selling

Foreign Institutional Investors have turned net sellers in recent sessions. FII selling usually puts pressure on large-cap stocks, which dominate Sensex and Nifty.

Reasons for FII selling include:

Reallocation to safer global assets

Dollar strength and bond yield movements

Profit booking after a strong rally

Even moderate FII selling can significantly impact benchmark indices.

4. Profit Booking After Recent Rally

Before the recent decline, Indian markets had rallied sharply. When indices approach higher resistance levels, short-term traders and funds often book profits.

This profit booking is a normal market behavior and often leads to temporary corrections without damaging the long-term trend.

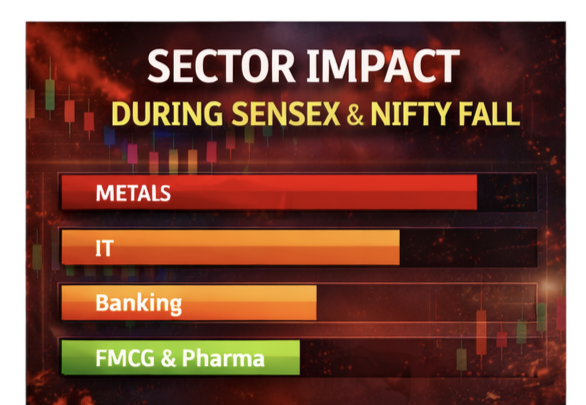

5. Sector-Specific Pressure

The selling pressure was more visible in certain sectors:

Metal stocks corrected after a sharp rally

IT stocks faced pressure due to global slowdown concerns

Banking stocks saw mild weakness due to valuation concerns

Since these sectors carry heavy weightage in the indices, even small declines resulted in broader index weakness.

Is This the Beginning of a Bear Market?

At present, the data does not indicate a long-term bear market.

India’s economic fundamentals remain strong

Corporate earnings outlook is stable

Long-term technical support levels are still intact

The current decline appears to be a short-term correction or consolidation phase, not a market crash.

What Should Investors Do During This Phase?

Long-Term Investors

Avoid panic selling

Stay invested in fundamentally strong stocks

Use corrections to accumulate quality companies gradually

Short-Term Traders

Expect higher volatility

Trade with strict stop-losses

Avoid aggressive positions until trend clarity improves

New Investors

This phase may offer better entry opportunities than buying at market peaks

Focus on companies with strong balance sheets and long-term growth visibility

Final Verdict: Market Correction, Not a Crisis

The two-day fall in Sensex and Nifty reflects temporary caution rather than structural weakness. Global uncertainty, FII selling, and profit booking have combined to create short-term pressure.

Market corrections are healthy—they remove excess optimism and create a stronger foundation for future growth.

Smart investors stay patient, disciplined, and focused on long-term value during such phases.