Gold prices in India and global markets saw another major uptick today, hitting fresh record levels and surprising buyers, investors, and even seasoned traders.

Most benchmarks tracked gold moving up again after days of strong gains, showing that the precious metal is still in bullish mode. Here’s everything you need to know. (The Times of India)

🟡 Record High Prices in India Today

On Tuesday, gold prices climbed sharply across major Indian cities, with key rates hitting new highs:

24-karat gold prices moved toward or above ₹1.48 lakh per 10 grams. (Financial Express)

22K gold saw corresponding gains, tracking closely with the pure gold rise. (Financial Express)

Silver prices also raced past ₹3 lakh per kilogram, another record mark. (The Times of India)

In some markets, subtle differences in city prices were seen, but the trend was universally upward. (NDTV Profit)

🌍 What’s Driving the Surge?

🛡️ Safe-Haven Demand on the Rise

Global uncertainty is the biggest driver behind this jump. Precious metals like gold are classic safe-haven assets — which means when markets feel shaky, investors rush in to protect capital.

Recent geopolitical tensions, including threats of new tariffs and rising global trade frictions, pushed investors toward gold and silver again. (Reuters)

🇺🇸 U.S. Policy and Dollar Moves

U.S. political moves and tariff threats have boosted gold’s appeal. (Reuters)

A softer U.S. dollar and expectations of lower global interest rates make gold less expensive for buyers in other currencies — which helps prices go up further. (Reuters)

These conditions are combining to lift gold above resistance levels and keep investor demand strong. (The Times of India)

📊 Short-Term Trend: Still Bullish

Market analysts are watching a few key indicators:

🔹 Record global prices — gold in international markets went beyond $4,700 an ounce on bullish flows. (Reuters)

🔹 ETF holdings rising — global gold exchange-traded funds have maintained elevated levels, indicating strong institutional demand. (The Times of India)

🔹 COMEX inventory lower than last year — further tightening supply. (The Times of India)

All of these are classic signals of a continuing uptrend in the near term. However, markets are volatile — especially with geopolitical headlines dominating flows. (The Times of India)

Perfect — here’s a clean, blog-ready visual explanation + projected price outlook you can directly use on Balanced Figure 👇

📊 Gold Price Trend & Projection (Visual Explanation)

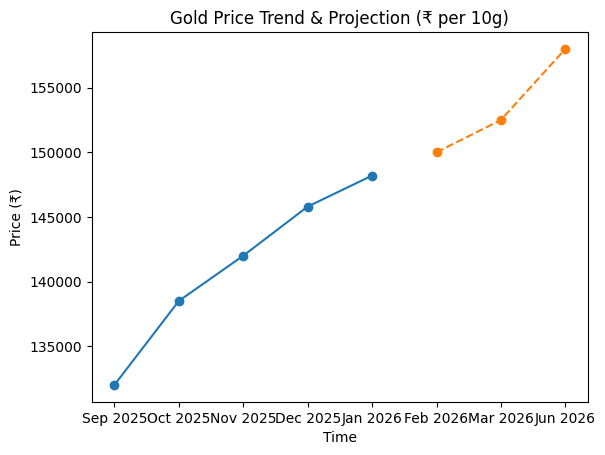

The chart above shows two clear parts:

🔵 Solid Line (Past Trend)

Gold prices have been consistently rising since Sep 2025, moving from around ₹1.32 lakh to ₹1.48 lakh per 10 grams by January 2026.

This confirms that the current jump is not sudden, but part of a sustained uptrend.

🔸 Dashed Line (Projection)

The dotted section represents near-term projections based on:

Safe-haven demand

Global uncertainty

Central bank buying

Weakening confidence in risk assets

🔮 Projected Gold Price Levels (₹ / 10g)

⚠️ These are estimated ranges, not guaranteed prices.

📅 Short Term (Feb–Mar 2026)

₹1.50 lakh – ₹1.53 lakh

Likely if global tensions continue and the dollar stays soft

📅 Mid-2026 Outlook

₹1.55 lakh – ₹1.60 lakh

Possible if:

Geopolitical risks remain

Inflation concerns resurface

Equity markets stay volatile

📉 Downside Risk (If sentiment cools)

Temporary correction to ₹1.42–1.45 lakh

Seen as a healthy pullback, not trend reversal

🧠 One-Line Insight for Readers

Gold is not reacting to one headline — it’s responding to a world that feels increasingly uncertain.

💡 What This Means for Buyers and Investors

Here’s a quick breakdown:

💍 For Jewellery Buyers

Prices are high. If you were planning a purchase soon, today’s rates are among the strongest in history — especially for 24K gold.

📈 For Investors

Gold is responding to risk and uncertainty, not just technical price patterns. That can mean:

✔ Suitable for diversification

✔ Useful hedge if markets dip

✔ Not immune to sudden pullbacks if tensions ease

Longer-term holders are benefiting from consistent gains, while short-term traders are watching charts closely. (The Times of India)

📌 Key Takeaway

Gold prices didn’t just rise — they surged on January 20, 2026, supported by:

🔹 Global uncertainty and safe-haven demand

🔹 Geopolitical friction and tariff threats

🔹 Strong institutional buying

🔹 Continued inflation hedge appeal

This isn’t a one-off spike — it’s part of a broader trend we’ve seen since late 2025. But like all markets, it’s influenced by politics, economics, and global sentiment — so stay tuned and watch the signals as they unfold. (The Times of India)