Venezuela’s Bolivar Collapse: Why the Dollar Soared Nearly 480% and What It Means for Ordinary People

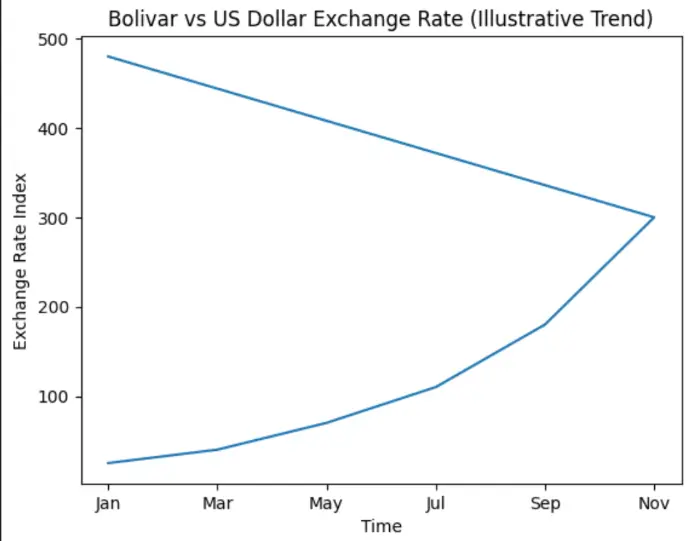

For many Venezuelans, checking the exchange rate has become as routine as checking the time. Not because they are traders or economists, but because the value of their money can change dramatically within months. Over the past year, Venezuela’s official dollar exchange rate has jumped by nearly 480%, signaling yet another deep crisis for a currency that has already endured years of collapse.

This is not just a story about numbers on a screen. It is a story about shrinking salaries, rising food prices, disappearing savings, and daily survival in an economy where trust in money itself has been broken.

The Bolivar’s Steep Fall in Simple Terms

The bolivar has been losing value for years, but the recent acceleration is alarming even by Venezuela’s standards. When the official dollar rate rises so sharply, it means the local currency buys far less than before. For people paid in bolivars, purchasing power erodes quickly, often faster than wages can adjust.

While the government maintains an official exchange rate, most Venezuelans rely on parallel or informal rates, which usually reflect real market demand more accurately. The widening gap between official and street rates shows how fragile the currency system has become.

Chart 1: Bolivar vs US Dollar (Yearly Trend)

Description of the chart:

A line graph showing the bolivar-to-dollar exchange rate over the past 12 months.

The line starts relatively lower at the beginning of the year

Gradually climbs for a few months

Then rises sharply, almost vertically, in recent months

The steep slope visually represents the nearly 480% increase

What it tells readers:

This chart makes it clear that the crisis did not happen overnight. It worsened steadily and then accelerated, suggesting policy pressure, reduced dollar supply, and growing loss of confidence.

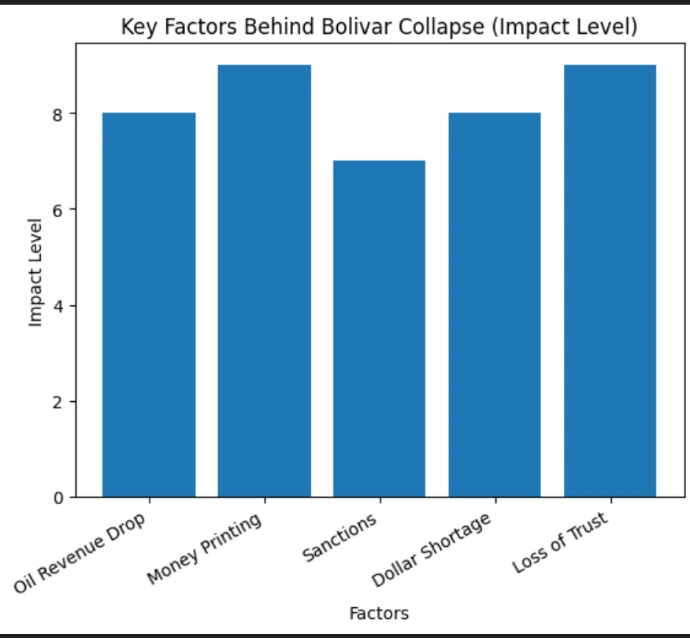

Why Is the Bolivar Collapsing Again?

Several forces are pushing the currency downward at the same time.

Venezuela’s economy still depends heavily on oil exports, which bring in foreign currency. When oil revenues fall or are restricted by sanctions, fewer dollars enter the country. To cover spending, the government often increases money supply, which weakens the bolivar further.

At the same time, businesses and individuals rush to protect their savings by converting bolivars into dollars. This demand pushes the exchange rate even higher, creating a vicious cycle.

Chart 2: Causes Behind the Currency Decline

Description of the chart:

A bar chart with key factors on the horizontal axis and impact level on the vertical axis.

Bars include:

Decline in oil revenue

Reduced foreign currency inflow

Government money printing

Sanctions and trade restrictions

Loss of public confidence

What it tells readers:

The tallest bars highlight how multiple pressures stack together, making recovery extremely difficult without structural reforms.

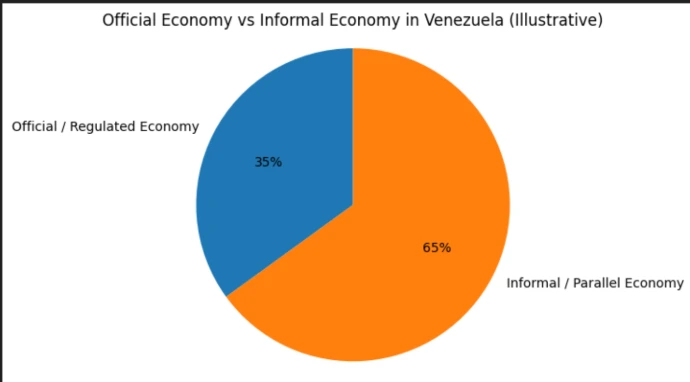

The Shadow Economy and the Mystery of Cash Seizures

Recent reports of massive currency seizures have added another layer of mystery. Authorities have confiscated large amounts of bolivars and foreign currency, raising questions about illegal markets, hoarding, and underground financial networks.

These seizures suggest that a significant part of Venezuela’s economy operates outside official channels. When people do not trust banks or currency stability, money moves into informal systems, making regulation and control even harder.

Chart 3: Official Economy vs Informal Economy

Description of the chart:

A pie chart dividing economic activity into two sections:

Official, regulated economy

Informal or parallel economy

The informal segment appears significantly larger.

What it tells readers:

This visual helps readers understand why official exchange rates often fail to reflect reality. Much of the country’s financial activity happens beyond government control.

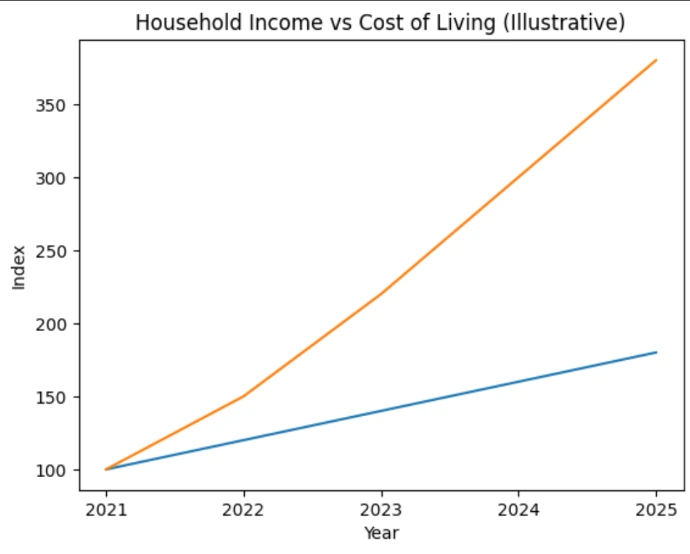

How Ordinary Venezuelans Are Coping

For many people, the bolivar is no longer a store of value. Salaries paid in local currency can lose meaning within weeks. As a result, Venezuelans increasingly rely on U.S. dollars, stablecoins, or barter-like arrangements for daily transactions.

Small shops price goods in dollars. Freelancers seek foreign clients. Families receive remittances from abroad. This informal dollarization keeps daily life moving but also deepens inequality, as not everyone has access to dollars.

Chart 4: Household Income vs Cost of Living

Description of the chart:

A dual-line graph:

One line shows average household income growth

Another shows the rising cost of essential goods

The cost-of-living line rises much faster.

What it tells readers:

Even when incomes increase nominally, they lag far behind real expenses, explaining why living standards continue to fall.

What This Means for the Future

The bolivar’s collapse is not just a currency issue—it is a reflection of deeper economic fragility. Without restoring confidence, stabilizing foreign currency inflows, and controlling inflation, the cycle is likely to repeat.

For global observers, Venezuela serves as a warning of how quickly money can lose meaning when economic fundamentals break down. For Venezuelans, it is a daily reality that shapes every decision, from what to buy to how to save.

Final Thoughts

A nearly 480% jump in the dollar exchange rate is more than a statistic. It represents lost stability, growing uncertainty, and a population adapting to survive without reliable money. Charts and graphs can show the scale of the problem, but the human cost is felt in kitchens, markets, and workplaces across the country.

Until trust in the bolivar is restored, the crisis will remain not just economic, but deeply human.Start writing here...