When economic headlines mention numbers like “$25 billion trade deficit”, it can feel abstract and worrying at the same time.

But this topic matters because trade numbers quietly affect things like currency movement, import prices, and long-term economic stability — even if we don’t notice it day to day.

So let’s understand what really happened in December, without panic and without complicated language.

First, a quick refresher: what is a trade deficit?

A trade deficit simply means:

A country buys more goods from the world than it sells to the world.

In December:

India exported goods worth around $38.5 billion

India imported goods worth about $63.5 billion

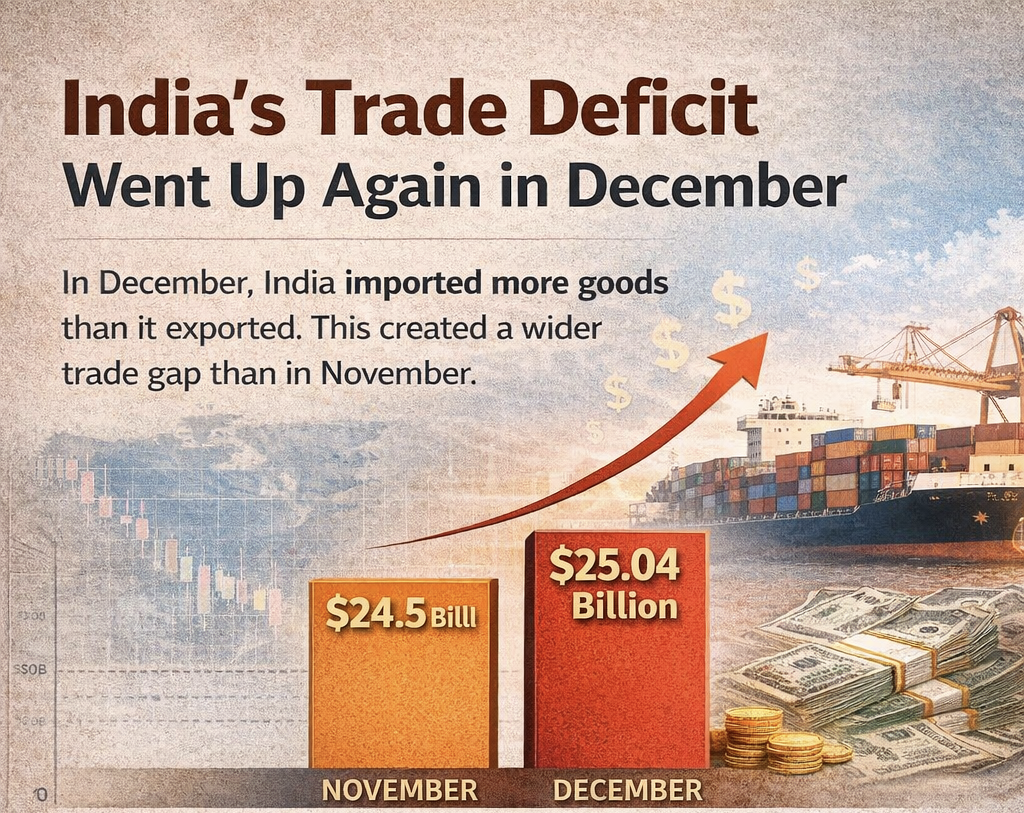

The gap between the two was $25.04 billion.

That gap is called the trade deficit.

Why did the trade deficit increase in December?

The increase didn’t happen because exports suddenly collapsed.

It happened mainly because imports grew faster than exports.

1. Imports stayed high

India continues to import:

Crude oil and energy products

Electronics and machinery

Industrial raw materials

Gold and other commodities

In December, the total import bill crossed $63 billion, which is relatively high.

Higher global prices and year-end demand both played a role.

2. Exports grew, but slowly

Exports were not weak, but they weren’t strong enough to balance imports.

Merchandise exports were around $38.5 billion

That was only about 2% higher than last year

Global demand remains cautious:

Europe is still slowing

China’s recovery is uneven

US demand is selective

So Indian exporters are selling — just not aggressively.

3. November was unusually low

In November, India’s trade deficit had dropped to about $24.5 billion, the lowest level in five months.

December looks bigger partly because November was relatively calmer.

This makes the jump look sharper than it actually is.

What’s happening behind the scenes (important context)

One thing headlines often miss:

India earns heavily from services, not just goods.

In December:

Services exports (IT, consulting, business services) were about $35.5 billion

Services imports were roughly $17.4 billion

That creates a services surplus of over $18 billion

This services income helps offset the goods trade deficit.

So while goods trade shows a gap, the overall external position is more balanced than it appears.

How does this affect normal people?

For most households, the effect is indirect, not immediate.

Possible mild impacts:

Imported goods may stay expensive

Fuel prices remain sensitive to global oil trends

The rupee may feel mild pressure if deficits stay high for many months

What is unlikely:

No sudden inflation spike

No immediate job impact

No emergency economic measures

This is not a shock situation — it’s a monitoring situation.

What does this mean for investors?

For investors, this data is more about trend-watching, not reaction.

Things that matter more than one month:

Whether exports recover over the next quarter

Crude oil price direction

Rupee stability

Global demand improvement

A single month’s trade gap does not change India’s long-term growth outlook.

Markets usually care about patterns, not headlines.

What people should NOT panic about

Let’s clear some common fears:

❌ This does not mean India is facing a crisis

❌ This does not mean foreign money is running away

❌ This does not mean the economy is slowing sharply

❌ This does not signal policy failure

Trade deficits move up and down — especially in large, growing economies.

What is worth calmly watching

Without fear, these are reasonable things to keep an eye on:

Export performance in early 2026

Oil price movement

Global economic recovery

Rupee movement

These indicators together matter far more than one data point.

The bigger picture

From April to December of the current financial year, India’s total exports have crossed $630 billion.

That tells us something important:

India is still trading actively with the world — buying what it needs and selling what it can, in a challenging global environment.

December’s trade deficit is a data signal, not a danger signal.

Final thoughts

A $25 billion trade deficit sounds large — but numbers need context.

What December really shows is:

Strong domestic demand

Steady but cautious exports

A global economy that is still uneven

For most people, the right response is not worry — just understanding.

Clarity matters more than headlines.