Introduction: When One Headline Shakes a Portfolio

You open your stock app in the morning.

Red numbers everywhere.

Adani stocks are falling—again.

News alerts mention the US SEC, summons, and billions wiped out.

If you’re an investor, or even someone casually following the markets, the first reaction is simple:

“What’s going on now—and should I be worried?”

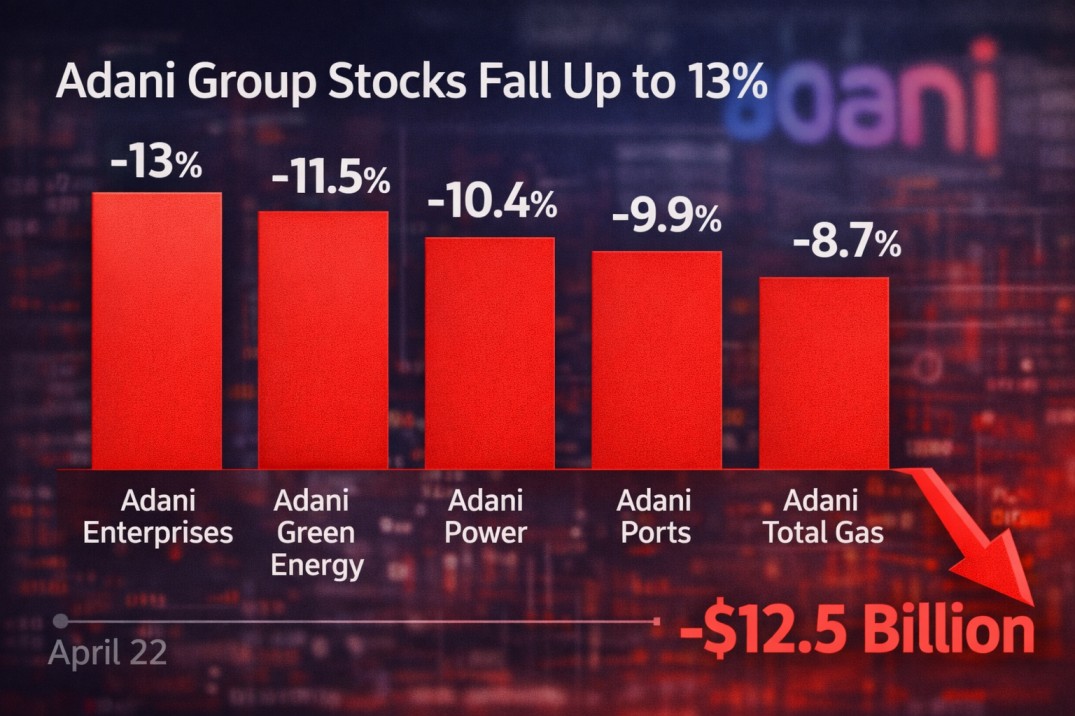

In just one trading session, Adani Group stocks lost nearly $12.5 billion in market value, with some shares falling as much as 13%. The trigger wasn’t earnings, debt, or oil prices—but a legal development in the United States.

This article breaks it all down:

What actually happened (without legal jargon)

Why markets reacted so sharply

What it means for Indian investors

And how to think about Adani stocks going forward

Context & Background: What Triggered the Fall?

The Simple Version

The US Securities and Exchange Commission (SEC) asked a US court for permission to serve legal summons via email to Gautam Adani and Sagar Adani.

This request is linked to an ongoing civil case involving allegations of fraud and a $265 million bribery scheme related to overseas investments and disclosures.

The moment this news broke, markets reacted.

Why This Was a Big Deal

Normally, serving summons is routine.

But this case stood out because:

The SEC claimed it faced difficulty serving notices through official government channels

Seeking court approval to serve summons via email is unusual

Investors saw this as a legal escalation, not just background noise

Markets don’t wait for verdicts.

They react to uncertainty.

What Happened in the Stock Market?

The Numbers at a Glance

Total market cap wiped out: ~$12.5 billion

Worst-hit stocks:

Adani Enterprises

Adani Green Energy

Adani Power

Adani Total Gas

Adani Ports

Intraday fall: Shares slide up to 13% in some companies

Broader Market Reaction

The Indian stock market reaction was cautious:

Nifty and Sensex slipped modestly

Selling pressure was mostly Adani-specific

Banking and IT stocks were relatively stable

This tells us something important:

👉 The market saw this as a company-level risk, not a systemic crisis.

Deep Explanation: Why Legal News Hits Stocks So Hard

1. Markets Hate Uncertainty More Than Bad News

A confirmed fine is bad—but predictable.

An ongoing legal process is worse—because no one knows the end.

Investors start asking:

Will there be penalties?

Could this affect overseas funding?

Will global institutions reduce exposure?

Even without answers, prices move.

2. Global Investors Are Extra Sensitive

Many Adani companies rely on:

Foreign institutional investors (FIIs)

Overseas bonds and dollar funding

Global ESG-linked capital

When a US regulator is involved, global funds don’t wait.

They rebalance first, analyze later.

3. Memory of the Past Still Lingers

Let’s be honest.

After the 2023 short-seller episode, Adani stocks carry a reputation risk premium.

Any fresh controversy—legal or regulatory—gets amplified.

This doesn’t mean guilt.

It means lower tolerance for uncertainty.

The Alleged $265 Million Bribery Case: What We Know

Here’s what’s important—and what’s not.

What Matters

It is a civil case, not a criminal conviction

Allegations relate to disclosures and overseas dealings

Adani Group has denied the allegations and said it will contest them

What Does NOT Matter (Yet)

No final judgment

No fines announced

No business operations halted

Markets reacted to the process, not the outcome.

How This Affects Common Investors (Not Just Traders)

If You Hold Adani Stocks

Ask yourself:

Is this a short-term trade or long-term holding?

Can you tolerate volatility?

Does Adani exceed your comfort allocation?

If your exposure is small and long-term, this may just be noise.

If You’re a New Investor

This episode is a lesson:

Concentrated bets = higher emotional stress

News risk is real, even for large groups

Diversification isn’t boring—it’s protective

👉 Read our Beginner Guide:

Internal Link: “How Stock Market News Impacts Share Prices (Beginner Guide)”

Data & Expert Insight

What Analysts Are Saying

Fundamentals of core businesses haven’t changed overnight

Legal overhang can cap stock rallies in the near term

Long-term outlook depends on:

Legal resolution

Balance sheet discipline

Execution consistency

Translation:

Business ≠ Stock price in the short term

Pros, Cons & Risks: A Balanced View

👍 Positives

Strong infrastructure assets

Revenue-generating core businesses

Government-linked sectors (ports, power, logistics)

⚠️ Risks

Legal uncertainty abroad

Sentiment-driven volatility

Higher scrutiny from global investors

❌ Cons

Sharp price swings

Repeated headline risk

Trust rebuilding takes time

What Should Investors Do Now?

For Conservative Investors

Avoid overexposure

Stick to diversified funds

Don’t chase rebounds

For Long-Term Investors

Track legal developments calmly

Focus on quarterly performance

Avoid panic selling on headlines

For Beginners

Learn from this case

Understand risk beyond numbers

Build discipline before conviction

👉 Related Article:

Internal Link: “Why Big Stocks Fall on Legal News Even When Profits Are Stable”

Future Outlook: What Happens Next?

Short Term (Next Few Weeks)

Volatility likely

News-driven price movement

Range-bound trading

Long Term (1–3 Years)

Outcome depends on:

Legal clarity

Cash flow stability

Investor trust rebuilding

Adani stocks won’t disappear.

But they may take time to regain confidence-driven premiums.

Conclusion: Stay Calm, Stay Informed

Stock markets don’t reward panic.

They reward patience, clarity, and perspective.

This episode isn’t about instant conclusions—it’s about understanding how markets process uncertainty.

Read headlines.

But decide with your head, not your heart.

FAQ Section

1. Why did Adani Group stocks fall sharply today?

Due to news that the US SEC sought court approval to serve legal summons, increasing uncertainty for investors.

2. How much market value did Adani Group lose?

Around $12.5 billion in combined market capitalization in one session.

3. Is this a criminal case against Adani?

No. It is a civil case, and no final judgment has been made.

4. Should retail investors panic sell?

Panic selling usually locks in losses. Decisions should depend on risk tolerance and time horizon.

5. Does this affect the Indian stock market overall?

Not significantly. The impact was largely limited to Adani Group stocks.

6. Are Adani businesses in trouble?

Operations continue normally. The issue is legal and sentiment-related, not operational.